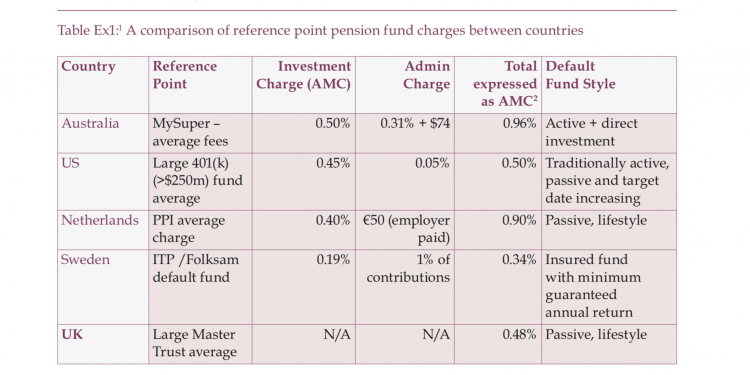

Dutch and Swedish DC charges to scheme members look competitive, but overall they are typically more complex with additional administration fees, in the case of the Netherlands, paid for by the employer.

The research found that the level of charges in the US and Australia has been reducing at around 2 per cent a year. This suggests that as DC pensions schemes grow so do the economies of scale – although the trend to invest in cheaper, passive funds may also be a contributory factor. The PPI says this statistic could inform the debate around a cut in the charge cap from 0.75 per cent to 0.5 per cent, as economies of scale could reduce charges by that level after 15 years.

The report highlights the improved transparency of costs in the Dutch pensions system and its reported impact in reducing costs, and sees current developments in the UK as working down a similar path. It found disclosure of investment transaction costs is most developed in the Netherlands, having introduced a voluntary disclosure regime in 2011 as part of the wider disclosure of pension fund costs.

Australia is introducing statutory disclosure of transaction costs as part of its wider RG97 disclosure reforms but this is on-going and incomplete.

In the UK more data is becoming available under the new EU PRIIPs and MIFID II disclosures, the FCA’s rules on disclosure to IGCs and trustees of DC schemes under PS17/20, and DWP’s regulations for publication and reporting of costs and charges by DC schemes. However, there is little analysis of this data so far. This may accelerate with the introduction of new voluntary investment fund disclosure sponsored by the FCA. There is no transaction data currently available for the US or Swedish funds.

The report also outlined the success of Sweden’s ‘Orange Envelope’ pension engagement campaign, which uses an eye-catching, instantly recognisable communication which is distributed once a year to all members to generate media and social interest to raise awareness.

A survey, conducted every year when the envelope is sent out, found that around three quarters of the envelopes are opened by members and around half are read in some part.

PPI head of research Daniela Silcock says: “The way in which economies of scale play out in the UK will be important to understand as part of the debate around value for money in DC pensions. Until recently, UK disclosure did not facilitate direct examination of how costs are changing as it does in the Netherlands or Australia. It may be important for all stakeholders in the UK market to have access to this data to manage outcomes better as scale grows in UK DC.”