LCP is warning clients that artificial intelligence is an emerging systemic risk for the industry.

The pension consultantcy said it recognises the rapid adoption of this technology across most industries at present, due to the benefits its offers in terms of efficiency and improved decision-making. However it says that AI also introduces new investment risks that will be difficult to mitigate due to their systemic nature.

LCP says there are a number of key key risk areas where AI could have far-reaching implications for investors and the broader financial system. This risks include:

- Opacity: As AI systems grow more complex, their decision-making processes may become harder to explain or audit, creating governance challenges.

- Herd behaviour: Widespread reliance on similar AI models could lead to correlated decision-making during periods of stress, especially in market trading.

- Cyber threats: The adoption of AI introduces new vulnerabilities that could heighten existing cyber risks.

- Climate impact: While AI can support climate solutions, its rising energy demands and reliance on data centres could slow progress towards net zero goals.

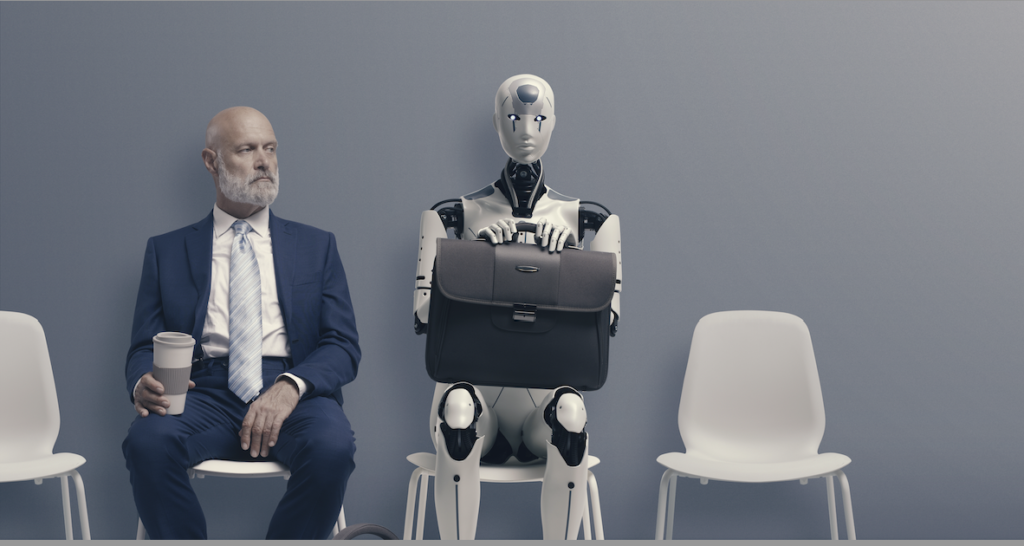

- Social disruption: AI will transform labour markets, offer new opportunities, but also raise concerns about job displacement and deepening global inequality.

To help investors navigate these challenges and harness AI’s potential responsibly, LCP recommends taking small but actionable steps. One important step is to add AI to the investment risk register as an emerging systemic risk, ensuring it receives attention and creating a foundation for future conversations and planning.

LCP also says that schemes and clients need to engage with investment managers to understand how they assess and manage AI-related opportunities and risks, at both the company level and the systemic level, and to establish how AI is being used within their investment processes.

LCP consultant Julian Thakar says: “AI is rapidly reshaping industries worldwide. While it creates exciting new opportunities, the investment risks are significant and growing. Investors do not need to have all the answers today, but taking small, proactive steps now can help them prepare for what’s ahead.”