FOR PROFESSIONAL CLIENTS ONLY – SPONSORED CONTENT

During 2020, we took a closer look at the impact of gender on retirement outcomes. In particular, we investigated whether being male or female has any bearing on what you can expect in your pension pot at retirement.

One of the most humbling aspects of our year in lockdown has been a renewed focus on the unpaid labour that goes on behind the scenes in homes around the world. The pandemic has both accentuated the volume of this work and thrown the spotlight on the people who juggle day jobs with keeping a household running – with schools shut for most of the year, wider family support limited, and elderly and disabled care options restricted. It’s clear that while women have in many cases borne more domestic responsibility than men, this is changing.

The current gender pay gap is well documented. Gender pay gap reporting came into force in April 2017 for UK organisations with more than 250 employees, which increased transparency and scrutiny on this area. But how do the different genders fare at retirement? Is there a difference and, if so, how much?

When it comes to pension savings, it’s still a man’s world

L&G’s book of pension-scheme members is evenly distributed between men and women, which makes a great starting point for our study. But what we find when looking at the distribution of wealth between these two populations is less positive. The average man retiring today has more than twice the retirement pot of a female colleague, with an average pot of £21,000 versus women’s average of £10,000. Women are more likely to retire with a small pot (defined as under £30,000) – 93% versus 85% of men.

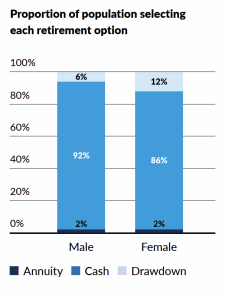

Across the book men are more likely to choose income drawdown

Perhaps unsurprisingly, women are less likely to choose drawdown, given the limited ability for small pots to sustain regular income.

Perhaps unsurprisingly, women are less likely to choose drawdown, given the limited ability for small pots to sustain regular income.

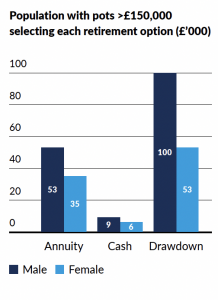

This difference in choice appears to be driven by the variation in pot size. As we can see, there is little difference in behaviour when we look at members with pots of over £150,000. Drawdown is the favourite option for all members with large pots, regardless of gender.

The average drawdown pot for men is just shy of £100,000, while women’s average drawdown pot is just over £52,000.

Drawdown pots between the genders have the largest gap of all the retirement options; this has a significant impact on the pot’s ability to generate sustainable income. Men that have exhausted their drawdown pots do so on average by aged 62.4, and after 9 payments. Women who have exhausted their drawdown pots do so after 5 payments on average, and by aged 62.2.

Men choosing to buy an annuity on average do so with one-and-a-half times the pot size of women.

Men choosing to buy an annuity on average do so with one-and-a-half times the pot size of women.

Women have an average pot of £35,000, while men have an average pot of £53,000. Women annuitise later than men do, on average at aged 64.6, while men annuitise on average at age 64.1.

Men cashing their pots on average do so with one-and-a-half times the pot size of women.

The average cash pot for a man is £9,000 and £6,000 for a woman. Men access cash slightly later than women do on average at age 61.3.

Closing the gap

For now, retirement behaviours are evolving in line with our expectations, with members increasingly relying on their pots for a regular but adaptable income. However, our deep dive into gender differences makes it clear that the average woman currently begins retirement less well equipped financially than a man.

As Kim Brown’s recent blog on the subject points out, changes in social and workplace practices are a step in the right direction to addressing the gender pension gap. The gender pay and pensions gap is a multifaceted and complex issue, and one holistic solution is unlikely to be the answer.

The government and employers can do more (and will need to act swiftly) to help women catch up with their male peers. As drastic as the situation sounds, there is much to be hopeful for as small steps to address the various sources of ‘slippage’ are starting to be taken.

Important Information: For professional clients only. Past performance is no guarantee of future results. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Views expressed are of LGIM as at 1 September 2021. The Information in this document (a) is for information purposes only and we are not soliciting any action based on it, and (b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not investment, legal, regulatory or tax advice.

Legal & General Investment Management Limited. Registered in England and Wales No. 02091894. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119272.

© 2021 Legal & General Investment Management Limited. All rights reserved. Legal & General Investment Management Ltd, One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority.