Several providers, all of whom wish to remain unnamed, have told Corporate Adviser they are considering making full use of the range of permitted charging options set out in the DWP’s Better Workplace Pensions paper, as well as introducing employer set-up fees.

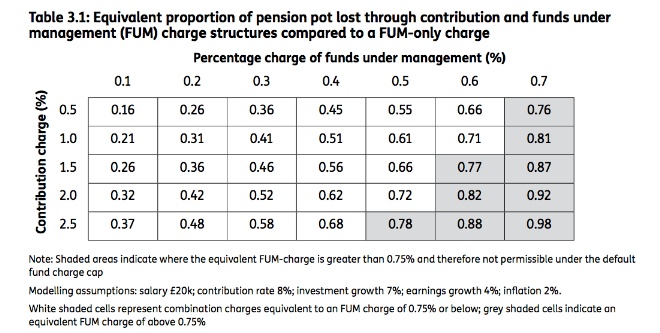

One provider said it is considering an up-front charge of 2.5 per cent with an AMC of 0.4 per cent for smaller schemes, as permitted by the DWP’s charge cap. The DWP maintains that a combination of contribution charge plus a lower AMC or a monthly flat rate admin charge plus a lower AMC works out broadly equivalent to an AMC of 0.75 per cent for the 10 different saver scenarios it modeled. The DWP has created ‘equivalency tables’ (see tables) that show permitted charging combinations. Areas on the tables shaded grey will not be permitted under the new rules.

Equivalence table 1

Providers considering the move say planning is at the early stages, but add that a break from their historic monocharge structure that has been in place since the introduction of stakeholder pensions in 2001, but would make targeting smaller employers more profitable.

One provider said: “An increase in charges up to the level allowed by the DWP in its recent Better Workplace Pensions paper is certainly under consideration.

“The big schemes can comfortably be delivered within the 0.75 per cent flat charge cap, but further down the food change more work has to be done than with bigger employers that have bigger HR departments. So yes, we could move to something approaching the maximums set out in the DWP paper.”

Another provider said: “A lot of people won’t like it because it is easier to measure across different schemes if everyone is using a simple percentage of funds charge. But it will make it easier to target smaller employers. We are looking at a combination of fees to the employer, up front contribution charges to the employee and annual charges.”

The DWP paper says: “In the case of contribution charge structures, the length of time saving is the key variable which impacts on the equivalent FUM charge and salary has no impact on the proportion of an individual’s pot lost through charges. For contribution charge structures, all individuals have therefore been modelled with a salary of £20,000. This is the median earnings for private sector workers in the eligible automatic enrolment population with no existing workplace pension2.

“In a flat-fee structure both length of time saving and salary will impact on the equivalency. To reflect this, the 10 individuals have been modelled at 3 salary levels £15,000, £20,000 and £28,000. This represents the 25th percentile, median and 75th percentile of the earnings distribution for private sector workers in the eligible automatic enrolment population with no workplace pension.

“For providers considering designing new schemes with combination charges, or for new entrants to the market wanting to use contribution charging, these equivalency tables will set the benchmarks for what charge levels are permitted in schemes used for automatic enrolment.”

Capita Employee Benefits head of marketing Robin Hames says: “It’s worth noting that a scheme with a 2 per cent initial charge and 0.5 per cent annual management charge would meet the new charge cap criteria. With ‘pot follows member’ potentially being introduced in the near future, this charging structure may seem attractive to many providers.

“We may therefore see a shift back to combination charges and away from the single deduction. This may mean that some members bear greater costs – especially those who regularly move employer or have periods in and out of employment.”