The Government’s Money and Pensions Service is reviewing whether it needs to adjust it guaranteed income guidance service to include a warning that annuities are unsuitable for Muslims wanting to abide by Shariah law.

The review comes after Corporate Adviser revealed that the MAPS MoneyHelper website includes a six-page guaranteed income guidance service that asks detailed questions about height, weight, alcohol intake and post code but does not as whether the user may have a religious or ethical problem with interest bearing products.

And unities are considered ‘Haram’, or against the principles of Shariah law, by the UK’s 4 million Muslim community, because they are based on interest based mechanisms (Riba). They are also often viewed as a form of gambling on longevity, which is also forbidden under Shariah law.

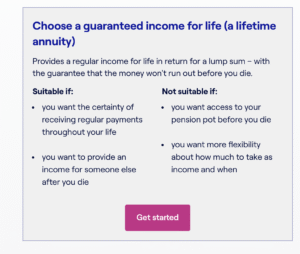

The MoneyHelper website includes boxes which give a series of scenarios where a product would be “not suitable” but does not include religious objections.

The MoneyHelper website includes boxes which give a series of scenarios where a product would be “not suitable” but does not include religious objections.

The issue highlights the challenge faced by non-advised targeted support solutions and flex then fix drawdown then annuity default retirement strategies.

Anna Sharkey from the Money and Pensions Service, says: “The MoneyHelper service provides guidance and so we don’t recommend specific products. Our Pension Investment Options information page on MoneyHelper explains that pension providers will offer a range of funds people can choose from when they are considering the best way to invest their pension, including those that follow Islamic (or Sharia) Law. MoneyHelper also provides information on Sharia-compliant products such as savings and Islamic mortgages.

“We can provide guidance around Sharia compliant finance through our money and pensions helplines and would encourage anyone who would like support with their pensions to visit MoneyHelper.org.uk. However, we are always looking to improve our guidance and will review if there is a need to adjust our guidance to better reflect the situation for those that follow Islamic (or Sharia) Law.”