Twelve major master trusts will incorporate illiquid assets within their default strategies, although a number will only offer this on higher-cost ‘premium’ default options.

Research by consultants Isio looked at the planned default design of leading pension providers over the next two years. Collectively these trusts have more than 100bn of assets under management.

Of these 12 master trusts — four plan to offer illiquid assets across a single default option. Seven trusts will offer a ‘dual’ default strategy, offering both ‘premium’ and ‘low cost’ defaults. However while three of these trusts plan to offer an illiquid allocation on both defaults, four said this would only be available on the higher cost option. One did not specify its strategy on this.

This means that out of the 12 trusts surveyed, seven will invest in illiquid across their default options.

Isio’s research also found that 10 of these master trusts plan to allocate to illiquid assets throughout their entire lifespan, while two will focus solely on their earlier growth phase (potentially extending over the long term).

Planned allocations to illiquid assets within the overall default structure vary significantly, with four providers estimating they will hold as little as 0-5 per cent during the growth phase, while two foresee allocating up to 16-20 per cent at this stage.

Isio’s research found that allocation size is heavily influenced by whether a provider is targeting one or two defaults.

Seven providers aim to begin implementing these changes within the next 12 months, with three providers aiming for the following 12 months.

Of the remaining providers, one has already confirmed implementation and one has yet to confirm their plans. Isio says this movement marks a significant evolution in the UK DC master trust market, promising enhanced investment strategies and diversified portfolios.

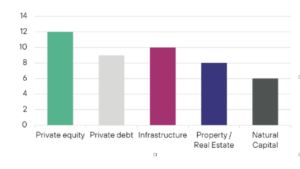

Providers are predominantly building diversified portfolios of illiquid assets, with private equity being the most popular choice, while real assets – particularly property and infrastructure – will also see large allocations.

Isio also found that all providers are utilising a mix of internal and external managers to handle their illiquid allocations. There is interest in a variety of investment vehicles beyond Long Term Asset Funds (LTAFs), which include blending co-investment or direct investment within the LTAF structure.

Isio partner George Fowler says: ”DC master trusts are clearly going to be big investors in illiquid assets in the years ahead, and they will form an increasingly important allocation within their default investment strategies.

“This approach promises to enhance portfolio diversification and potentially deliver better long-term outcomes for members, and we expect schemes to prioritise increasing these allocations in the growth phase. The next 12-24 months will be crucial as providers implement these changes, and we look forward to supporting our clients to realise the opportunities.”