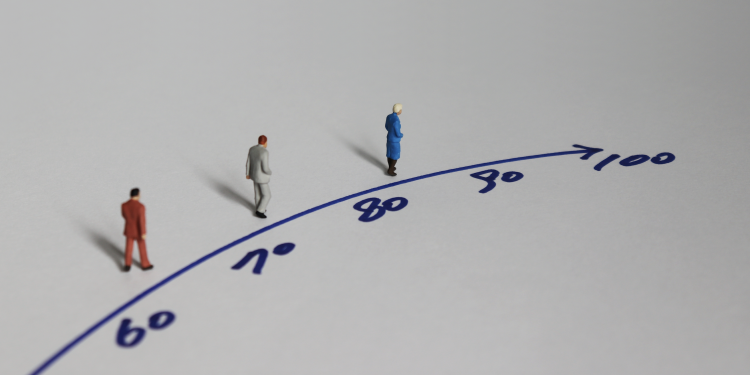

Nearly 38 per cent of baby boomers are set to retire later than the current state pension age of 66 as retirement income falls over a third, according to research.

According to research by Dunstan Thomas, nearly half of UK baby boomers have not yet retired and 23 per cent of working 58 to 75-year-olds want to stay in paid full-time jobs beyond 66 while 47 per cent want to stay in paid part-time jobs.

Almost 9 per cent of baby boomers who are currently working full-time said they “never want to stop working” and 12 per cent of people are still undecided. Only 18 per cent are adamant about avoiding working past the current state pension age.

Additionally, the average annual pre-tax household income of all working UK baby boomers was £44,979.20. But in this latest study, the average yearly pre-tax household income of retiring boomers drops to £30,255, a loss of over a third or 32.74 per cent upon retirement.

Nearly 48 per cent of baby boomers still have access to more generous Defined Benefit (DB) pensions, which significantly improve their retirement income prospects. A fifth of boomers or 19 per cent have employer-sponsored Defined Contribution (DC) plans, and a quarter or 24 per cent have personal DC plans including Sipps, while 14 per cent rely only on their state pension entitlement. Boomers gain an average of 57 per cent of their total retirement income from all pensions including the state pension. Just a third of boomers derive or expect to derive over 80 per cent of their total retirement income from their pension policies.

But according to the study, an increasing number of baby boomers are planning to release equity from their homes or downsize to free up more funds in retirement. 6 per cent of boomers have already done so, and the same percentage have downsized to have access to capital. More than one-sixth of boomers or 17 per cent plan to reduce their house to supplement their retirement income, and 8 per cent expect to release equity to supplement their retirement income.

Dunstan Thomas director of retirement strategy Adrian Boulding says: “Many Boomers are clearly financially supporting their children and increasingly grandchildren. And what they are likely to be setting aside for this purpose could well run into the thousands of pounds per year. This level of subsidisation by Boomers is worthy of further investigation because it has clear implications for the retirement income levels they will need to support their ambitions to help younger generations.”

“Indeed, these new findings suggest that many retired Boomers may already be living well below the Moderate Retirement Living Standard level outlined by the PLSA once this level of intergenerational subsidisation is factored in. It goes some way to explain the increasing appetite for downsizing and equity release amongst Boomers for example.”

Boulding added: “Our study reveals selfless behaviour by many Baby Boomers as they allow their own living standards to fall below the PLSA ‘moderate’ retirement living standards in order to maintain financial support to children and grandchildren.

“It also helps explain why retirement ages are drifting upwards. We are seeing early indications that retirement income levels are falling below what many need and that’s before the impact of DB pension closures are truly felt. The DB to DC switch is set to hit the next generation of retirees – Generation X – much harder of course.”