Fewer people are seeking advice or guidance about their options before accessing their pension, according to the latest data from the Financial Conduct Authority.

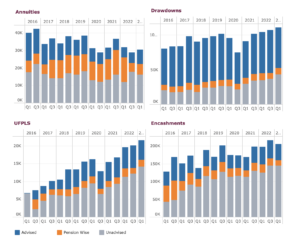

The FCA’s latest retirement income market data shows a rising number of unadvised transactions for those taking one-off (UFPLS) payments from their pension, going into drawdown or cashing in their retirement savings in full.

This trend can be seen over an eight year period, with the FCA first collating this data in 2016 in the wake of the pension freedom rules. Although a far higher number of people now access their pension, a higher proportion of these transactions are made without recourse to guidance via Pension Wise or financial advice.

However the figures show there was a moderate increase in the number of people seeking financial advice before buying an annuity when compared to the previous survey, taken six months ago. However the longer term trend shows that fall in advised annuity sales over this period.

Canada Life retirement income director Nick Flynn says that this data shows less than half of people (47 per cent) seek advice or before buying an annuity, and this is trending downwards, compared with the same period two years previously, where 58 per cent of people sought advice or guidance.

He says: “It is really disappointing to see inertia continue to play a big role in retirement income decisions, with far too many people not exercising their right to shop around for not only the best rate, but also the right shape annuity for their individual circumstances.”

He adds: “Improving the availability of guidance and encouraging more people to seek the help of an annuity broker or independent financial adviser, rather than simply accept the status-quo from their pension provider, will provide better lifetime consumer outcomes.

“This is especially important as annuities are enjoying a renaissance, driven by the demand from customers seeking security in times of uncertainty, combined with the significantly higher incomes available.”

Pension expert and director of public affairs at The Lang Cat Tom McPhail says: “One of the first things that jumps out at me regarding the latest FCA retirement data is the significantly increase in non-advised transactions.”

He added that this data made the FCA’s review into the boundary between advice and guidance timely. This review is looking to redefine advice definitions, with a view to introducing more ‘personalised’ guidance services, which would give people a lower cost option when compared to ‘full fat’ financial advice. It is hoped this might encourage more to seek help their retirement choices.

This retirement income review shows that more than half of all pension pots are now fully encashed, the most popular way people access their pension benefits. Around a third of pension savers opt for some sort of drawdown, with just 8 per cent opting to buy an annuity.