Government plans to speed up consolidation and push private markets into DC are moving faster than the system can safely support.

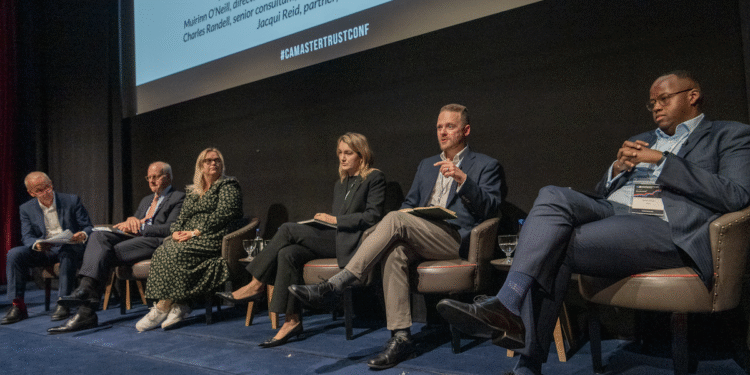

That was the dominant sentiment during a panel discussion at the Corporate Adviser Master Trust Conference, where speakers also highlighted the challenges of integrating private markets into DC defaults and the need for clearer regulatory guidance to protect member outcomes.

Slaughter and May senior consultant and former FCA chair Charles Randell emphasised the significance of government policy while noting its unpredictability. He described it as “a really important policy” and said he is “highly supportive of it,” though he admitted he could not forecast how many providers might remain. He highlighted that “the optimisation of pension funds is one of the big opportunities to drive growth in the UK.”

Randell also warned that “engagement is low, especially among the most vulnerable,” and that by default, many people are placed into government-selected investments. He added that the trust placed on ministers may not always be justified.

Aon DC Consulting associate partner Yassin Isman suggested consolidation has been gradual but warned of limits. He said: “We’ve seen a lot of consolidation over the last ten years. It continues in trust, especially at the smaller end of the master trust market. To an extent, it has already worked.”

He added that while change is coming, the next five to ten years are unlikely to see dramatic shifts, noting “The industry is battling lots of change through the pension schemes bill, not just consolidation.”

Sackers partner Jacqui Reid agreed that consolidation is likely but gradual. “There’s enough in the pension schemes bill for alternative ways of getting to scale that it won’t be any time soon. So I think it’s quite optimistic.”

Panellists highlighted private markets as a critical but challenging component of DC strategies. Standard Life investment development lead Alasdair Birrell stressed the wide dispersion of outcomes and the importance of experienced managers. He explained that private markets are “a game changer for expectations and member outcomes,” and that consultants at EBCs will be key to understanding strategies and managers.

He also noted the challenges of integrating private markets into member products, highlighting the need for gradual, multi-asset diversification. Members should pay only for investments they are actually receiving, he said, and performance fees, common across private market strategies, require transparency and scrutiny to ensure fairness.

BlackRock director of government affairs and public policy Muirinn O’Neill emphasised that as DC schemes mature, some are taking more responsibility for private market allocations, working directly with niche managers. She also stressed that while defaults are becoming more consolidated, flexibility remains crucial as member needs cannot always be predicted.

Randell cautioned that government-led defaults could overlook member interests. He noted that some individuals might be excluded from benefits and questioned whether well-performing investments could be removed.

He also said: “Trustees and providers should do what’s best for pensions. Then there’s the question of UK assets and what benefits the economy. Continuation funds just flipping the same equity asset doesn’t obviously do very much to the economy in my mind.”

Reid added that mandation alone will not ensure trustees act in members’ best interests, highlighting that compliance is a lengthy and complex process.

She also explained that VfM assessments are typically backwards-looking, based on quantitative measures, and don’t align with high-cost, longer-term private markets.

Birrell reinforced the need for transparency, noting that reporting costs and performance fees should be scrutinised to ensure fairness and regulatory parity.

The panel agreed that the industry must prioritise member outcomes over speed as consolidation and private market integration advance.