Half of us (50%) feel overwhelmed by the amount of information on pensions, and 4 in 10 don’t know what to do with it all, according to Standard Life’s Retirement Voice 2022 report. The report, now in its second year, surveyed the views of almost 6,000 people from all walks of life, from across the UK.

In addition, the research found that just 21% of women have done a great deal of planning or thinking around how much money they need to live on in retirement. For men, that figure is higher at 35%.

Meanwhile, more than a third (35%) of women have done no planning at all, compared to 19% of men. And 34% of women vs. 21% of men say they don’t know how to review their long-term finances.

These findings seem to suggest that it’s difficult for people to plan for retirement if they don’t feel that they understand pensions well enough – and this appears to be part of the problem.

Offering targeted education and communication is therefore key to helping people feel less bogged down by information, and more in control of their finances – which could have a big impact on their overall financial wellbeing.

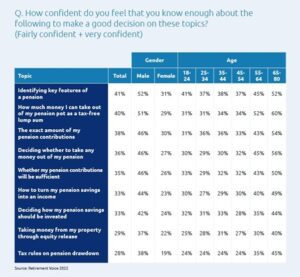

Women and younger people are the least confident about their pension knowledge

On average, women and younger people are generally less confident that they have enough knowledge of pensions to make good decisions.

Meanwhile, people aged 65–80 are typically the most confident, followed by those aged 55–64.

Why are people feeling overwhelmed by pension information?

One the reasons people lack confidence in their knowledge of pensions could be the nature of the information available.

And whilst half of the population find the amount of retirement planning information “overwhelming”, this number is even greater for women at 56%.

People aged 18–24 are most likely to feel overwhelmed (63%), followed by the next youngest age groups (62% for 25-34-year-olds and 57% for 35-44-year-olds). Those already retired or closer to retirement feel least overwhelmed.

Many people also say they have no idea what to do with the information they have. Again, people aged 18–24 feel this most often, followed by the next youngest age groups. Women are also more likely to feel this way compared to men (48% vs. 35%).

This indicates that more effective and readily available financial education could boost many people’s financial planning and overall financial wellbeing.

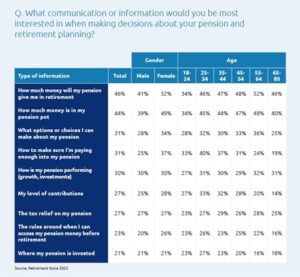

So, the question is: what information would people find most interesting?

Understand what information employees need

Across genders and age groups, most are interested in knowing how much money their pension will give them in retirement, and how much is in their pension pot.

Women also prioritise wanting to make sure they’re paying enough into their pension, followed by wanting to understand what options or choices they can make about their pension. Those aged 25–34 also take a heightened interest in making sure they’re paying in enough, which tapers off as they get closer to retirement age.

This shows that the pension information people are looking for differs. By understanding what information employees need, your clients can adopt a tailored – rather than one-size-fits-all – approach to their financial education offering.

Deliver targeted financial education and comms

The research shows that many people still do no retirement planning, and the nature of the pensions information available appears to be part of the problem.

Clearly, there is value in taking a targeted approach to helping people. Some cohorts need more support than others, whilst other groups are looking for answers to particular questions. How people digest that information differs too, be that via videos, written content, or in-person events.

Therefore, it’s vital that we tailor pensions information to make it less overwhelming, and more relatable to people’s specific needs.

Where people access advice and guidance varies. But wherever they turn to, it needs to be personal, relatable, and provided in a simple and engaging way.

For more insights and tools, visit our Financial Wellbeing hub and read our articles.