Scotland’s introduction of five income tax rates and bands for 2018/19 has triggered calls for clarity from the Scottish Government as to how tax relief on pensions will be treated.

The ‘starter’ rate, of 19 per cent, applies to those earning between £11,850 and £13,850 of taxable earnings. Scotland does not have the power to introduce different tax thresholds, so the same nil rate band as applies in the UK will pertain. Between £13,850 and £24,000 will be taxed at 20 per cent, with an extra 1 per cent income tax for the ‘intermediate’ bracket of £24,000 to £44,273. Higher and top rate taxpayers pay 1 per cent more.

Pension providers are calling for clarification as to whether those paying tax at 19 per cent will still be entitled to relief at 20 per cent. Currently, non-taxpayers can obtain relief at 20 per cent through relief at source schemes up to gross contributions of £3,600. They also want clarity that intermediate, higher and top rate taxpayers will be entitled to commensurate tax relief.

Providers are predicting increased levels of enquiries to HMRC as potentially hundreds of thousands of people who have never had to file a tax return before will have to do so to obtain their full level of tax relief. Levels of relief will be relatively low, although not insignificant – an intermediate rate taxpayer who makes a contribution of £80 that is grossed up to £100 through relief at source should be entitled to a further £1 relief.

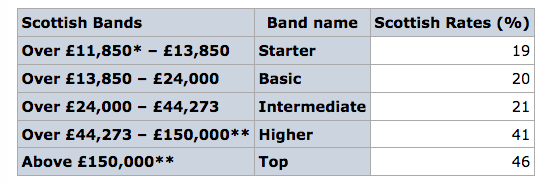

Scottish Income Tax Rates and Bands for NSND income

| Scottish Bands | Band name | Scottish Rates (%) |

|---|---|---|

| Over £11,850* – £13,850 | Starter | 19 |

| Over £13,850 – £24,000 | Basic | 20 |

| Over £24,000 – £44,273 | Intermediate | 21 |

| Over £44,273 – £150,000** | Higher | 41 |

| Above £150,000** | Top | 46 |

Aegon pensions director Steven Cameron says: “Today’s Scottish Budget announced new rates and bands of income tax for those deemed as Scottish taxpayers. For those earning above £33,000, this will mean their income tax will go up from next April and their take-home pay will reduce. This signals the Scottish Government is making greater use of its devolved tax raising powers and means an increasing number of Scottish taxpayers are paying higher income tax than those earning the same elsewhere in the UK.

“The introduction of additional tax bands creates uncertainty about how these will be applied to pension tax relief. Currently pension tax relief means the cost to a 20 per cent taxpayer of £100 pension contribution is £80, and £60 for a 40 per cent taxpayer. For personal pension schemes, pension providers currently collect contributions net of basic rate tax, which remains at 20 per cent across the UK, with individuals claiming extra relief through tax returns.

“We now need urgent clarification that those paying 21 per cent, 41 per cent or 46 per cent will now be entitled to more relief. But perhaps even more importantly, the Scottish Government must make clear that those paying 19 per cent won’t have to pay something back to the tax man.”

Hargreaves Lansdown senior pension analyst Nathan Long says: “A seismic overhaul to Scottish income tax looks set to provide opportunity for those saving for retirement. All of a sudden the incentive to save for retirement is now greater in Scotland for those earning over £24,000 and those earning between £11,850 and £13,850 than the rest of the UK.

“We could see canny Scots deferring their pension contributions until the new tax year in order to benefit. Of course this relies on the legislation being passed which will not be known until February. With only basic rate tax relief claimed automatically by pension providers there will be huge numbers of Scots forced into filling in a tax return.

“Pension schemes will be rushing to ensure they can explain the different rates of tax relief in a coherent manner. Whilst these changes are clearly wider ranging than pensions, added complexity simply diverts resources from where they can do most good, by helping people take individual control of their retirement plans.”