SPONSORED CONTENT

The 21st Scottish Widows Retirement Report sent shockwaves through the media, with the startling revelation that 39%* of the UK population may fall short of a basic standard of living in retirement.

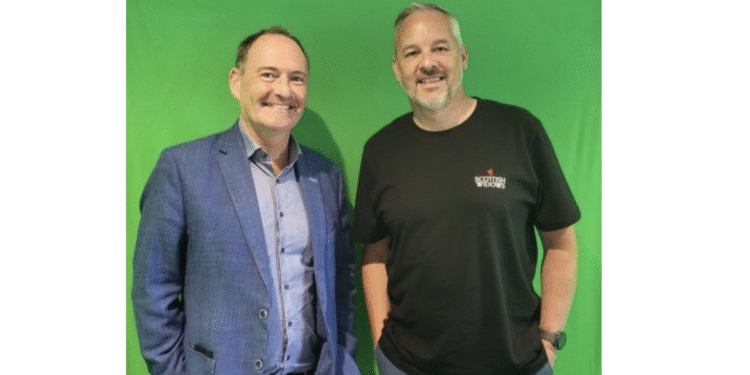

In this episode, Pete Glancy – the report’s author and friend of the podcast – joins Robert Cochran for an exclusive deep dive beyond the headlines.

Together, they unravel the of this year’s report, explore the implications for future retirees, and share practical actions that can be taken to help secure a more comfortable retirement. All the time trying to outdo the AI version of the podcast.

Listen to the podcast here: Retirement Report Podcast.

Read the full report here.

*2025 Scottish Widows Retirement Report

Read the latest news, expertise and thought leadership from Scottish Widows’ workplace pensions experts – visit here.