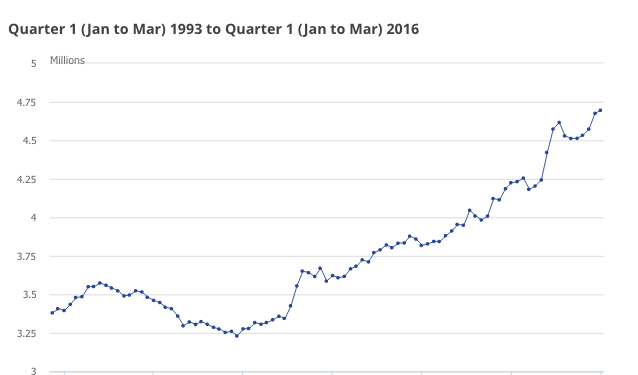

Self-employed pension saving has more than halved in a decade, with just 14 per cent of non-employed workers putting money away for retirement in 2014/15, compared to 31 per cent in 2005/06.

The DWP figures showing bleak retirement prospects for self-employed workers on the same day the Work and Pensions Select Committee launched a new inquiry into self-employment and the gig economy.

The DWP figures show that for the first time female participation in the private sector has overtaken that of males, with 70 per cent of eligible women now saving in a pension scheme, compared to 69 per cent of men.

There has also been an increase in scheme membership in the non-eligible worker group, where participation rose from 16 per cent in 2012/13 to 24 per cent in 2014/15.

The annual total amount saved for eligible employees across both sectors stands at £81.8 billion in 2015, an increase of £1.4 billion from 2014.

Annual total amounts saved increased in both public and private sectors from 2014. The public sector increased by £0.9 billion and the private sector by £0.6 billion. Overall in 2015, contributions by employees accounted for 30 per cent of saving, with employer contributions accounting for 60 per cent, and tax relief the remaining 10 per cent.

People earning over £40,000 continue to have the highest participation levels, in both the public and the private sectors, with 96 per cent of eligible public sector high earners employees participating in a workplace pension in 2015 and 85 per cent in the private sector.

In 2015 workplace pension participation was highest in the energy & water sector, with 87 per cent of eligible employees participating and lowest in agriculture & fishing with 37 per cent participating.

But in the private sector the industry seeing the largest increase between 2014 and 2015 was agriculture & fishing, from 24 per cent to 35 per cent. The manufacturing industry also saw around an 11 percentage point increase in the period. Since 2012 the largest increase has been seen in the distribution, hotels &

restaurant industry, where participation rose from 27 per cent to 64 per cent.

Providers have hailed the figures as a qualified success, pointing out that the amounts people are saving are lower, on average, than before.

Aviva savings and retirement manager Alistair McQueen says: “2016 has been a year of surprises. While much about the future may remain uncertain it can be stated with confidence that failing to address the growing retirement savings gap in 2017 will only result in a bigger gap in the years to come.

“Over 6 million savers have positively embraced auto-enrolment since 2012 and near 300,000 employers have successfully implemented the new system. There is support and there is momentum. This must be maintained in 2017.”

Now: Pensions CEO Morten Nilsson says: “Auto enrolment is working in reversing the persistent decline in workplace pension saving. But, these headline statistics can mask an uncomfortable truth.

“While 6.9 million people have been auto enrolled, research from the Pensions Policy Institute shows that around 6 million have been excluded. Of these, 3.3 million have been disbarred as they don’t earn £10,000 per annum – the trigger for inclusion in auto enrolment and, over three quarters of employees earning less than the auto enrolment trigger are women.”

Aegon head of pensions Kate Smith says: “We’re moving in the right direction, but the picture isn’t entirely rosy. Too many people are still committing just the minimum contribution rate of 1 per cent, matched by a 1 per cent employer contribution, which simply won’t build up a pension pot large enough to provide an adequate income. With contribution rates set to rise in the next four years, we have a window of opportunity to make sure that workers are actively engaged with their pensions rather than just increasing contributions because they have to.”

Old Mutual Wealth pension expert Jon Greer says: “The figures shows there has been a steep decline in pension saving in the self-employed over the past decade. Less than one in five are now partaking in the pension saving system. With the number of self-employed people growing significantly in recent years, fuelling the economy through a challenging period, it is absolutely critical that this large and vital part of the workforce are not forgotten by the pensions system. It is encouraging that the Pensions Minister has said he will see if it is possible to find a mechanism to bring the self-employed into automatic enrolment, but it is unlikely that that will be a quick and easy thing to do. The government needs to ensure that it is easy to implement the scheme as the self-employed don’t have the payroll systems of big employers. Instead, pension saving could be facilitated for them through national insurance, for example.

“In the upcoming review the government also needs to address pension saving for those on low pay. The £10,000 threshold should be brought down or abolished. It is not acceptable that the lowest earners miss out of tax relief and employer pension contributions enjoyed by their peers. There has been a big focus on the terms of employment for those on low-pay, and part-time or even zero-hours contracts, but they are still second-class citizens when it comes to pensions.

“The DWP data shows an increase in participation in the non-eligible group – those employees earning less than £10,000 – rising from 16 per cent in 2012/13 to 24 per cent in 2014/15. But this is still not enough. Too many people in this group are missing-out on the tax-relief and employer contributions enjoyed by their colleagues in better paid positions and this is not fair. This auto-enrolment exemption applies even if people working multiple jobs below £10,000 have a combined pay over the qualifying threshold.”