Smart Pension is the latest provider to sign up to the Make My Money Matter campaign, committing to an investment approach that will achieves net zero emission well ahead of a 2050 deadline set out by the Paris Climate Agreement.

As part of this campaign Smart Pension has also committed to halve scheme emissions earlier than the 2030 deadline.

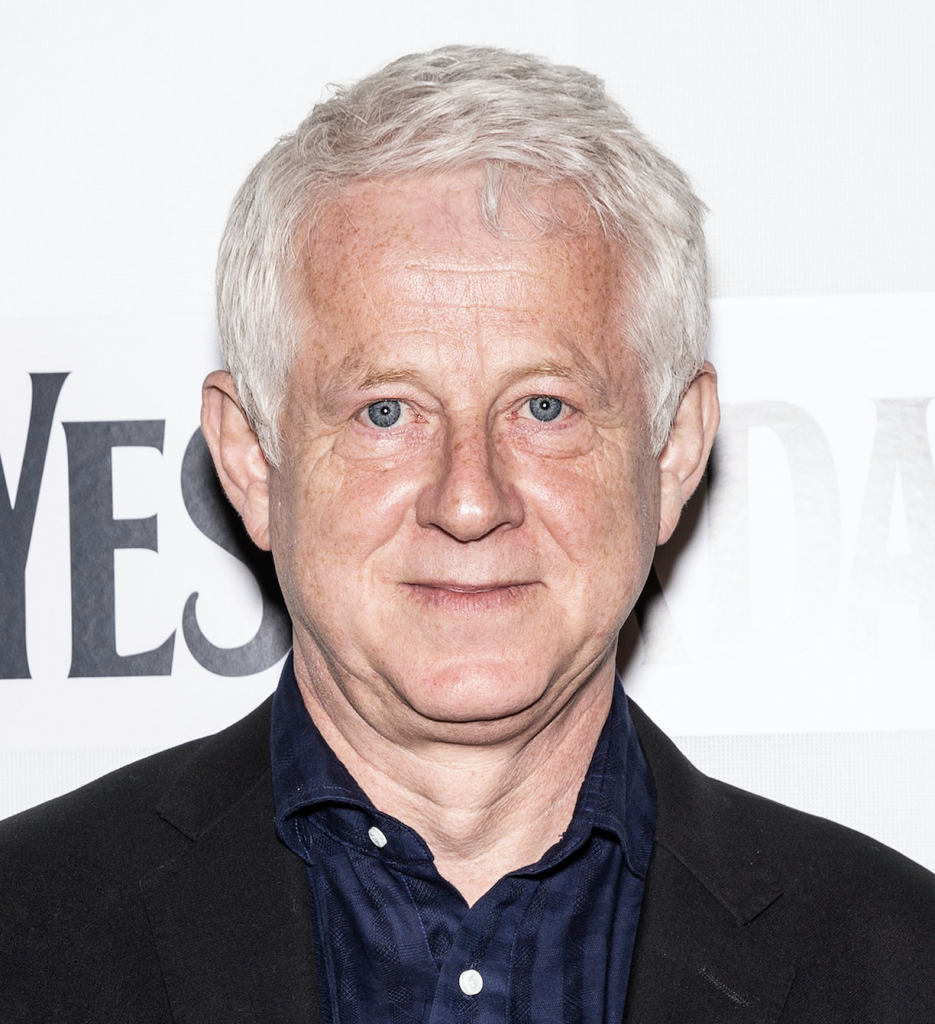

Make My Money Matter is the campaign group set up by Four Weddings and a Funeral Director Richard Curtis, and aims to get financial companies and pension providers to commit to net zero emissions across their investment portfolios.

Smart Pension says it is aiming to set an industry example ahead of a Glaswegian COP26 later this year. During Q1 2021, Smart Pension will also introduce an allocation to a new Social Impact Fund, which will capture investment opportunities that offer solutions to broader environmental and social challenges such as healthcare solutions for ageing populations, social housing, technologies to improve the use of water and gender equality in employment.

Smart says will continue to develop its proposition in 2021, to invest in products that tackle the climate crisis where it is in members’ best interest.

Smart says that in tackling the negative impacts of climate change, it is helping build a better world for its members as they retire. The transition to a lower carbon economy is expected to have a material impact on the value of investments over each member’s pension lifespan – meaning that the pledge should bring both positive environmental and financial outcomes for Smart Pension’s members.

Smart Pension Master Trust managing director Paul Bucksey says: “Climate change is one of the most important issues facing each and every one of us. But achieving great risk-adjusted returns for members while investing for long term environmental and societal benefits aren’t mutually exclusive objectives, and it is important that trustees and scheme sponsors grasp the opportunity that this offers.

“Having repositioned the Smart Pension default investment strategy to focus on companies with high Environmental, Social and Governance (ESG) scores, and with an upcoming additional allocation to Social Impact, we’re delighted to underline our commitment to sustainable investing by partnering with Make My Money Matter.

“We are really excited about the difference our scheme can make over the short and medium term, and are currently actively working with our partners to develop funds that actually decarbonise the economy rather than offsetting in other ways – which does not address the real problem.”

MMMM founder Richard Curtis adds: “Smart Pension’s announcement sets a glowing example for the pensions industry.

“In pledging to take action now and make these changes in advance of the deadlines, Smart aligns itself with the aims of the Paris Climate Agreement that seek to limit global warming to a maximum of 1.5 degrees Celsius and avoids paying corporate lip service.

“As one of the first master trusts in the UK to appoint a head of sustainable investing, we applaud the further measures that Smart Pension will take – such as proactive impact investment into solutions that actively tackle climate change and social issues.

“This robust pledge shows that the pensions industry can harness its hidden superpowers to not only deliver healthy returns, but also a healthy planet to retire into.”