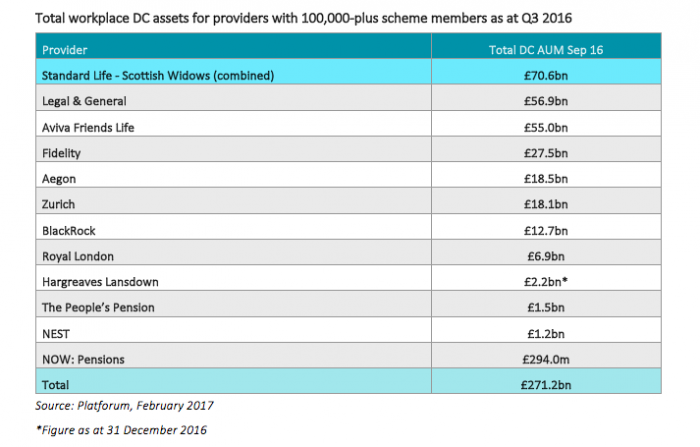

The rumoured merger of Standard Life and Scottish Widows would create the biggest DC pension provider in the UK with over £70bn of assets under management, says research consultancy Platforum.

Media speculation about a potential merger of the two pension providers has been growing in recent days. Both providers have declined to comment on the rumours, and takeover rules mean Standard is barred from talking to any other party until its deal with Aberdeen is completed, which is expected to take place in mid-August. That deal would create an asset manager with £620bn under management.

A recent circular to shareholders said: “Since Aberdeen acquired Scottish Widows Investment Partnership Limited in April 2014, Aberdeen and Lloyds have enjoyed a strong business partnership and Lloyds remains a key customer of Aberdeen. It is the intention that the Combined Group will explore ways in good faith to build a successful relationship with Lloyds for the benefit of their respective customers, businesses, shareholders and other stakeholders.”

A merged Standard/Scottish Widows provider would oust Legal and General, with £56.9bn of pension assets, as the UK’s largest DC provider. Aviva Friends Life, currently with £55bn of pension assets would be pushed into third place were Standard and Widows to merge.

Platforum head of intermediary research Miranda Seath says: “Both pension providers target similar profiles of employers with similar contribution levels: medium to large employers with above average contribution levels. This potential acquisition seems likely to be investment led – after Aberdeen’s acquisition of the SWIP book there will be substantial investment management synergies and close ties remain through Lloyds 10 per cent stake in Aberdeen.

“Scottish Widows has largely shaken off its auto-enrolment woes and by the end of 2017, Lloyds Banking Group will have spent £70 million on upgrading Scottish Widows’ digital proposition. This would be of benefit to Standard Life if it plans to keep the proposition and front-end technology separate following a merger, which seems likely given its strategy for the Elevate and Standard Life Wrap platforms.”