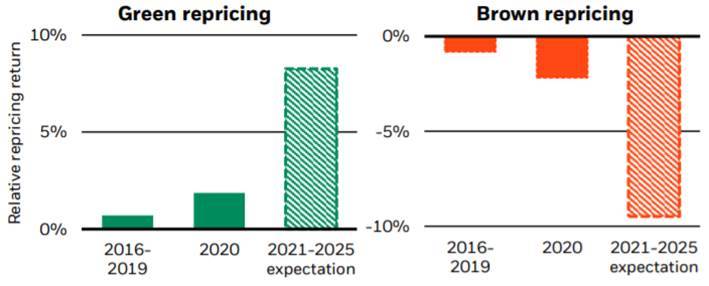

The world’s biggest asset manager says it has clear evidence that the drive towards sustainability is leading to a repricing of assets across the board, with green sectors set to surge 8 per cent between 2021 and 2015 while brown sectors will fall 9 per cent.

BlackRock says repricing towards lower carbon assets has accelerated from less than 1 per cent across the four years from 2016 to 2019, increasing to around 2 per cent in 2020, and will continue into the middle of the decade at least.

Relatively green sectors such as IT and brown ones such as utilities experienced a positive and negative repricing in 2020, respectively, says BlackRock.

To estimate climate-driven repricing, the BlackRock Investment Institute attributes historic returns to cash flow news and discount rate news.

In 2020 BlackRock predicted ‘a tectonic shift towards sustainable assets’ as capital and investments would start to flow to more sustainable assets and away from less sustainable ones. New analysis from the asset manager suggests the repricing effect is real and growing, as it was negligible in the period 2016-2019 (the left bars in the charts). It says it believe the repricing has much more room to run, based on factors such as investor preferences for greener assets and historical changes in risk premia for similar long-run transitions such as demographics (the right shaded bars).

A report from BlackRock says: “If that’s right, why have browner assets such as fossil fuel companies staged such a rally in the past year? Context is key. First, our repricing analysis controls for factors not directly tied to the long-run transition, such as surging demand amid the unique restart of economic activity last year. This exposed an underlying fragility in energy markets: a mix of geopolitical factors and weather-related supply disruptions hit just as European inventories were low. The result: spiking prices of fossil fuels and their producers. Second, the performance of traditional energy stocks tells you something about how the economy is currently wired. But it doesn’t say anything about where it’s going.

“The rewiring will involve a massive re-allocation of resources, in our view, and transform the macro environment. There will be periods when traditional energy can benefit from mismatches in supply and demand. The root cause is that transition of the energy sector has so far been lopsided, we believe, with extra investment in renewables failing to keep pace with reduced capex in fossil fuels. The higher fossil fuel prices rise, the more competitive renewables become. The outlook for renewables is bright, and we also see lower-carbon fossil fuels playing a key role in ensuring continuity of affordable energy during the transition. The world will need to pass through shades of brown and green to reach net-zero by 2050, we believe.”

“We see the transition driving a relative return advantage for greener sectors such as tech and healthcare over browner sectors such as energy for years to come, all else equal. There will be periods when browner assets outperform, and we see investment opportunities in low-cost oil and gas producers leading decarbonization within their sectors. Withholding capital or indiscriminately divesting from these industries is counterproductive to the transition and investor portfolios, in our view.”