The study found investors more focused on sustainability were markedly more confident in achieving their return expectations, with 59 per cent at least reasonably confident of meeting their expectations, compared to 37 per cent of investors who did not prioritise investing sustainably.

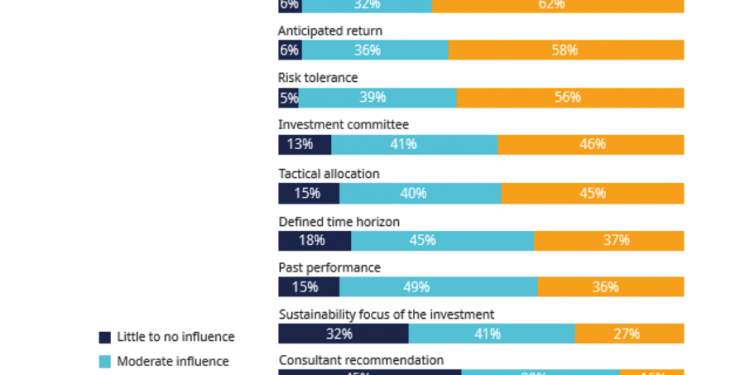

It found 32 per cent of investors said that the sustainability focus of the investment had little to no influence on their investment decision-making, making it significantly less important than factors such as strategic asset allocation, fund manager track record, anticipated return and risk tolerance.

But sustainability was found to be a bigger focus for larger institutional investors with longer-term investment horizons, more investment confidence and prioritised risk-adjusted returns. The research, carried out amongst 650 investors encompassing approximately £15 trillion in assets, found that 32 of those with holding periods of at least five years stated that sustainability was a significant influence. This compares to 23 per cent of investors whose investment horizon was between three and five years.

They also focused on generating risk-adjusted returns, with 66 per cent targeting this approach compared to 53 per cent who were less focused on sustainability.

Overall, 74 per cent of investors globally stated that investing sustainably would grow in importance over the next five years, up on 67% a year ago. A little under half – 47 per cent – said they had increased their allocations to investing sustainably over the last five years. Corporate strategy, climate change and accounting quality were identified as the most important issues investors should engage companies on.

But77 per cent admitted they found investing sustainably at least somewhat challenging – the same proportion as last year. Performance concerns were at the forefront of their challenges, with 51 per cent citing this as an obstacle to investing sustainably, up on 44 per cent a year ago.

A lack of transparency and difficulty measuring risk were the other main challenges investors said hindered investing sustainably.

Schroders global head of stewardship Jessica Ground says: “There remains a gulf between institutional investors’ sustainable investment aspirations and the reality of how they prioritise these factors in their investment decision-making.

“Investors clearly recognise that investing sustainably is going to be more and more important going forward, but this approach is yet to sit at the heart of their investment process.

“This study demonstrates that investors who prioritise investing sustainably tend to have longer-term investment horizons and greater confidence about achieving their return targets.

“Empowering investors to think longer-term and avoid making short-term, knee-jerk investment decisions has also been a growing focus of policymakers globally.

“Over time, this study highlights that sustainability is going to increasingly sit alongside institutional investors’ more long-standing investment priorities, although there still remain barriers to overcome to achieve this in the near term.”