SPONSORED CONTENT

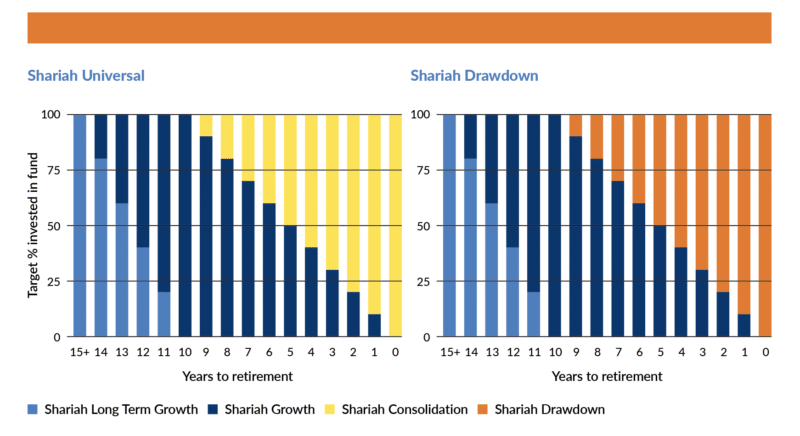

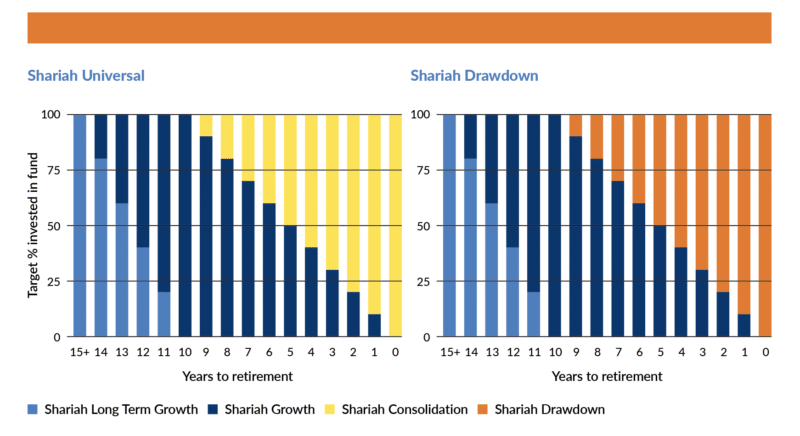

Aviva has recently launched its new Shariah Lifestyle Investment Strategy, partnering with global fund manager HSBC to utilise their range of Shariah-compliant funds. We’ve done this to provide our members with a de-risking solution that gives them options for how they wish to access their savings in retirement, and in a way which is compliant with Shariah Law. Aviva’s harmonised Shariah strategy benefits from the same tried-and-tested investment philosophy that underpins its other flagship auto-enrolment default solutions. By using a three-fund approach, which starts to de-risk from 15 years before retirement, we’re aiming to provide greater opportunity for growth in members’ pots, whilst ensuring we’re progressively managing risk exposure throughout their journey to retirement.

As with our other solutions, customers can wait to choose how to take their savings. We’ve also created a drawdown option for customers who want to take a regular income from their savings. The graphs below show how the two options move members’ money as they approach retirement.

![]()

The problem we are addressing

“Faith-based investors have been an underserved segment of the market1 and that’s what we have addressed with the launch of our new strategy.“Ulitmately, the biggest concern regarding Shariah investments is the lack of access so many people have to it2. The single greatest barrier to implementation is availability for members and that’s why we are so passionate about bringing our solution to market.

“Using our already proven risk reduction philosophy to design a Shariah-compliant strategy that takes customers through the retirement journey is something we’re incredibly pround of.”

Umar Yaqoob, investment proposition manager at Aviva

The increasing Islamic population in the UK has previously been underrepresented in the pensions market. However, things are changing. There is greater choice thanks to new Shariah-compliant funds, such as the multi-asset and Sukuk bond funds in the HSBC Shariah-compliant fund range, alongside the HSBC Islamic Global Equity Index Fund4. We’ve therefore used our know-how of pensions and investments, as well as our relationships across the industry to deliver an Islamic de-risking pension solution with multiple retirement options. This strategy shares the same investment design as our other auto-enrolment default solutions.

Shariah-compliant investments, which exclude certain sectors such as tobacco and alcohol, have been available in the

UK since at least the early 2000s. However, this has not covered all asset classes, reducing the ability to diversify and reduce risk. For example, de-risking pension solutions typically rely on bonds to reduce risk as members approach retirement. However, the Islamic ban on interest (Riba) has made this asset class unsuitable for inclusion in Islamic-compliant portfolios. The development of the Sukuk bond, first introduced in 20006, solves this problem, enabling pension providers to offer Shariah-compliant investors a full de-risking solution for the first time.

There has also been growing interest from investors in Islamic funds. This has been helped by the outperformance of the HSBC Islamic Global Equity Index Fund versus non-Shariah-compliant global equity funds. It has also coincided with more investors looking for investments aligned with their values and faiths, and not wanting to invest in industries deemed harmful, such as tobacco. In this context, it’s important to emphasise that Shariah-compliant investing and by extension, our strategy, is available to all, whether that be for faith-based purposes, ethical investment preferences or purely performance.

Aviva’s Shariah Lifestyle Investment Strategy

| Aviva Insured Funds |

Fund Cost (bps) |

Asset Allocation |

| Shariah Long Term Growth |

0.27 |

100% Equity |

| Shariah Growth |

0.33 |

Equities 74.93%

Sukuk bonds 16.23%

Alts 5.90% |

| Shariah Drawdown |

0.35 |

Equities 50.03%

Sukuk bonds 36.93%

Alts 8.70% |

| Shariah Consolidation |

0.34 |

Equities 35.08%

Sukuk bonds 55.78%

Alts 6.10% |

1 Muslims missing out on pensions worth £13bn due to sharia concerns, Pensions Expert, June 2021 – https://www.pensions-expert.com/Law-Regulation/Muslims-missing-out-on-pensions-worth-13bn-due-to-sharia-concerns?ct=true

2 Islamic Finance & Financial Inclusion, World Bank, p.23, Oct 2013 – https://documents1.worldbank.org/curated/en/611351468337493348/pdf/WPS6642.pdf

3 Islam in the UK, Statista, July 2024 – www.statista.com/topics/4765/islam-in-the-united-kingdom-uk/

4 Islamic Capabilities, HSBC Asset Management, November 2024 – https://www.assetmanagement.hsbc.co.uk/en/institutional-investor/capabilities/etfs/islamic-investment-range