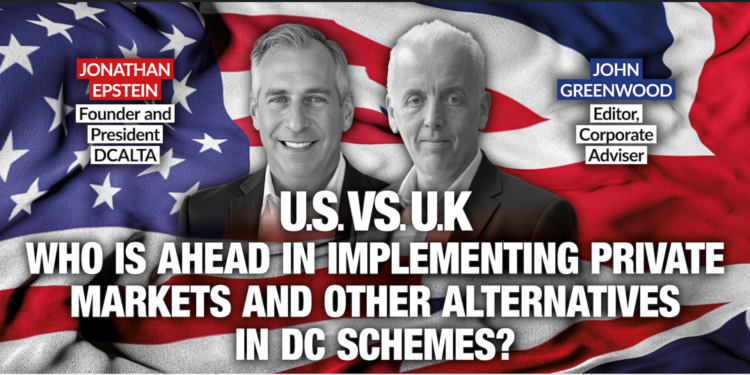

This webinar, hosted by John Greenwood, editor, Corporate Adviser and Jonathan Epstein, president and founder, DCALTA, brings together experts from both sides of the Atlantic to explore the different approaches each nation is taking to private markets and other alternative assets.

MEET THE PANEL:

Anne Lester, non-executive director, Partners Group

Bob Long, CEO, Stepstone Private Wealth

Lydia Fearn, partner, DC & financial Wellbeing, LCP

Mike Ambery, retirement savings director, Standard Life

Topics for debate:

- The huge difference in policy approaches between the US and UK towards implementing private market assets in DC

- Implementation of alternative assets to date in both countries

- How the US and UK are approaching the fiduciary considerations of alternative asset implementation

- How alternatives deliver value for money in terms of performance, risk management and charges

- The technical challenges of bringing alternative assets to unitised, daily-priced products such as DC pensions

Watch this dynamic session now for a clear view of where the US and UK stand today, what each market can learn from the other, and what these developments mean for the future of retirement investing.