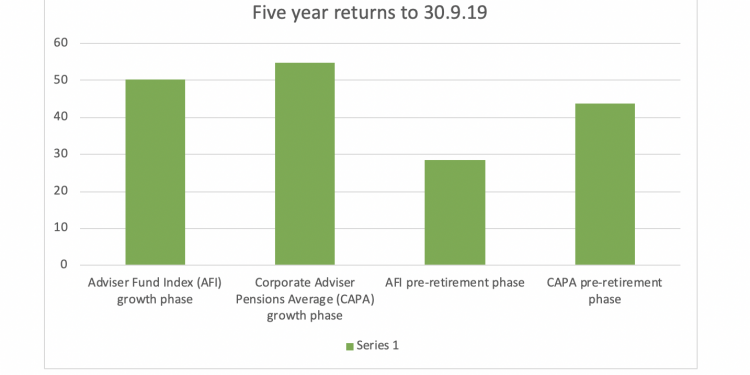

Investors in workplace pensions have received returns 16.8 per cent higher than investors using financial advisers in the five years to Q3, 2019, new research from Corporate Adviser reveals.

Older investors, with five years to state pension age (SPA) in 17 master trust and GPP defaults covering more than 12 million investors, saw returns of around 43.8 per cent, compared to just 27 per cent for the average older saver using a panel of 19 leading financial advisers.

The research analyses the data collected by Corporate Adviser to create the Corporate Adviser Pensions Average (CAPA), which tracks the average return for pension investors in the growth phase (30 years to SPA) and pre-retirement phase (5 years to SPA, currently an investor aged 61).

The 5-years pre-SPA cohort of CAPA investors saw annualised average returns of 8.03 per cent before charges, or 7.53 per cent after typical charges of 0.5 per cent – a compound return of 43.8 per cent.

That is 16.8 per cent higher than the return of the FE AFI Cautious portfolio, which delivered a return of 28.6 per cent (5.2 per cent annualised), according to data from Trustnet.

The AFI data reflects returns after asset management charges but does not include platform charges. Factoring in a typical platform cost of 0.3 per cent, the return through the advised route for pre-retirement investors is around 27 per cent.

The FE AFI Cautious portfolio is a weighted aggregation of the funds recommended suitable for a person in their late 50s.

The CAPA cohort reflects those aged 61, a few years older than the FE AFI Cautious portfolio.

In the positive markets of the last five years a CAPA investor two or three years younger would have been exposed to either equal or more risk and so their returns would have been either equal or greater.

The CAPA data shows that younger master trust and GPP investors in the growth phase of accumulation also enjoyed better average returns than those experienced by advised clients.

CAPA constituents delivered growth phase investors an average annualised return of 9.65 per cent for the five years to 30.9.19, before charges are deducting.

CAPA defines growth phase investors as those with 30 years to state pension age (SPA), currently someone 38 years old. The same performance would be delivered for virtually all members of younger ages as derisking starts much later than 30 years from retirement for virtually all workplace pension defaults.

On the basis of a typical 0.5 per cent charge for workplace schemes, this results in a net return of around 9.15 per cent annualised, or 54.9 per cent compound growth over the period.

That return is 2.7 per cent higher than the 52.2 return net of fund management charges delivered by the FE AFI Aggressive portfolio, before platform charges are included.

Factoring in a 0.3 per cent platform charge gives a return net of asset manager costs and platform charges of 50.2 per cent, 4.7 per cent lower than the workplace schemes.

The FE AFI Aggressive portfolio is an aggregation of the recommended portfolios for a person in their late 20s saving for a pension to be taken at age 65 submitted by 19 leading financial advisers.

Through the AFI, each firm selects a portfolio of funds for each themed index, according to the skills and expertise of their organisation. The portfolios that the panellists submit must have a maximum of 10 holdings, which are weighted by the panellist. FE aggregates each panellist’s portfolios to obtain an overall list of constituents and weightings.

Lloyds Banking Group head of pension investments, investment strategy & execution Maria Nazarova-Doyle says: “This research seems to indicate that while during earlier years of the growth stage the results are quite similar, when it comes to pre-retirement, advisers on aggregate have been potentially more cautious over the last 5 years than workplace providers. This is quite interesting as it is commonly believed that those wealthier investors who are advised by IFAs have more capacity and higher willingness to take risk, while workplace pension defaults are meant to cater for an average auto enrolled member with a medium level risk tolerance.

“Having said this, the advantage of having an IFA provide advice tailored to a specific individual is that this approach allows for this advice to be truly bespoke to the needs and wishes of that particular person. So perhaps it’s the advised high net worth individuals who are very cautious about their retirement prospects, and not necessarily their advisers? With the lingering fears of a potential market correction, who knows – perhaps the tables will be turned completely in another 5 years?”

*Do you have data on pension performance to share with Corporate Adviser? If so, contact john.greenwood@definitearticlemedia.com?