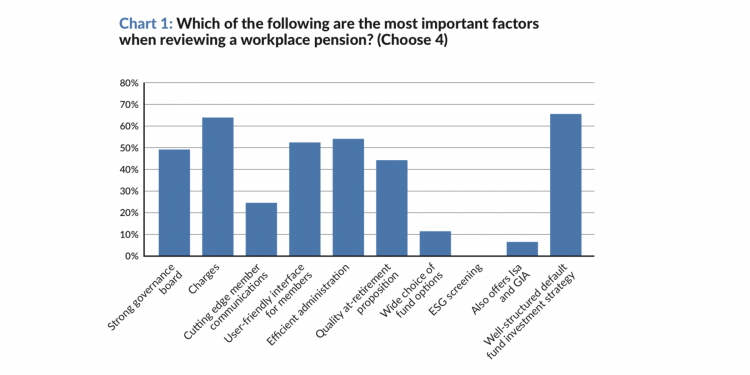

The data shows investment proposition is now even more influential than charges and efficiency of administration, with 66 per cent of consultants and advisers citing as one of the four most important factors when selecting workplace pension provider, compared to 64 per cent who cited charges and 54 per cent for efficient administration.

Even allowing for a margin of error, the fact that the investment strategy of the default fund now ranks on a par with charges in terms of importance when recommending providers marks a significant change in the way intermediaries are evaluating workplace pension providers.

The data reflected research carried out with more than 60 senior consultants and advisers.

The data comes from the Workplace Savings Report published today, which also covers corporate Isas and other savings vehicles, as well as detailed provider analysis – to request a copy of the 52-page report, click here.

The report also reveals that Legal & General is the UK’s largest workplace pensions provider, running DC assets of £72.3bn, 20 per cent higher than its nearest rival, Aviva on £60.9bn.

Scottish Widows sits just behind Aviva with £58.5bn, while Aegon’s deal with BlackRock has taken its assets to £39bn, just ahead of Standard Life.

| Provider | Total DC assets |

| Legal & General | £72.3bn |

| Aviva | £60.9bn |

| Scottish Widows | £58.5bn |

| Aegon | £39bn |

| Standard Life | £37.9bn |

| Fidelity | £30.6bn |

| Royal London | £7.8bn |

| Hargreaves Lansdown | £3.11bn |

(All data to 30.6.18 except L&G, to Dec 17, Aegon to Sept 18)

The report shows that Hargreaves Lansdown dominates the corporate Isa market, running assets of £333m. Standard Life is the only other provider running more than £100m of corporate Isa assets, with £118m. L&G and Scottish Widows have tiny corporate Isa books, way below 1 per cent of the value of their corporate pension books.

| Provider | Total corporate Isa assets |

| Hargreaves Lansdown | £333m |

| Standard Life | £118m |

| Aegon | <£25m |

| Legal & General | £4.7m |

| Scottish Widows | £3.8m |

| Aviva | Not disclosed |

| Fidelity | Not disclosed |