Demand for pension transfers out of defined benefit has almost quadrupled over the last two years, with the number of analysis requests to Selectapension exceeding 5,000 in November 2016, compared with just over 1,100 in January 2015.

Looking at last year as a whole, the firm, which delivers pension transfer analysis functionality to a large proportion of the IFA market, saw a 66 per cent increase in DB cases analysed by advisers and paraplanners in 2016, compared to 2015.

November 2016 saw a record number of transfer requests, coinciding with a peak in transfer values as a result of weakening gilt yields, falling back to just over 4,000 requests in December 2016. December 2016’s figures were 120 per cent up on the same month in 2015.

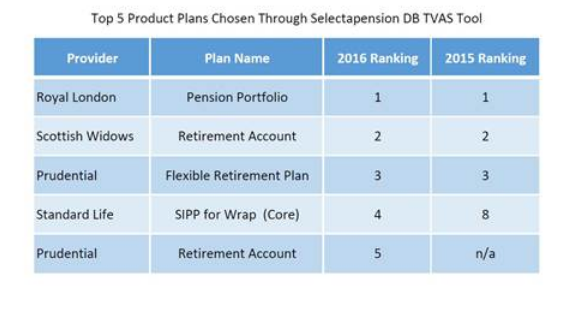

Royal London’s Pension Portfolio product was the wrapper most frequently transferred into by Selectapension customers, followed by wrappers from Scottish Widows, Prudential and Standard Life.

Royal London’s Pension Portfolio product was the wrapper most frequently transferred into by Selectapension customers, followed by wrappers from Scottish Widows, Prudential and Standard Life.

Selectapension national accounts director Peter Bradshaw says: “Transferring out of a DB scheme is a complex process, and it can also be a lengthy one. With full scheme information, a TVAS report can be produced within an hour, but the whole transfer process can take months.

“We welcome the recent FCA’s guidance on pension suitability which recognised that clients’ personal circumstances can trump critical yields.’’