AIG Life adds virtual GP health service app for all customers

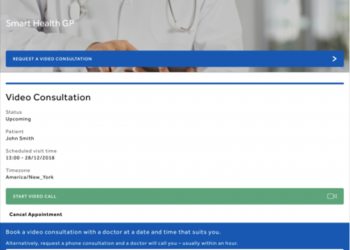

AIG Life is adding a virtual GP and health service to all of its individual and group protection insurance offerings. The online tool called Smart Health gives all AIG Life individual customers...