The Government has been challenged to demonstrate the extent to which it has encouraged pension trustees to ensure their investments manage climate risk and comply with treaties on human rights.

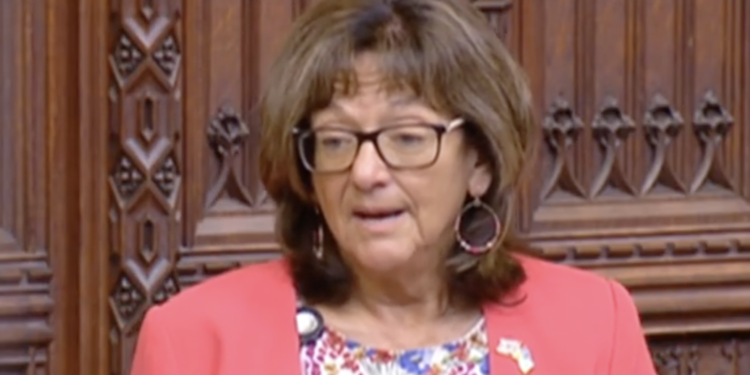

Speaking in the House of Lords yesterday, Baroness Altmann cited data from Corporate Adviser’s ESG in DC Pensions Report 2023 (request your copy here) which demonstrated how some UK pension schemes do not fully exclude investment in the manufacture of certain controversial weapons from their portfolios.

Altmann argued that because at least 25 per cent of all pension fund assets came from tax relief, that means the Government has a justifiable interest in ensuring investments are made responsibly.

Altmann said: “..as at least 25 per cent of all pension fund assets originated from taxpayer reliefs, does [the parliamentary under-secretary of state, DWP] agree that the Government have ample justification to expect pension funds to invest responsibly, supporting national objectives? Does he share my concern that this seems not to be happening? For example, Corporate Adviser magazine’s February 2023 ESG report shows that the three largest pension providers invest in cluster munitions, even though the UK is recent president and signatory of the international agreement to end their use, and that investment in domestic companies and green projects has been weak. Will the Government encourage or ensure that more of the taxpayer contribution to all pension funds helps UK markets and supports UK sustainable growth and climate and nature protections, to meet social or national objectives?”

Labour peer Lord Rooker questioned whether it was right for the Government to influence the investment decisions of DC pensions.

He said: “What legal authority do the Government have to attempt to create a de facto sovereign wealth fund by manipulating our pension assets? Unlike countries such as Norway, we do not have experience of running a sovereign wealth fund. I feel uneasy. I want the investment to be in this country—that makes sense—but doing it in the way it seems to be being done is fraught with difficulty. Will the Government take extra care over this attempt to manipulate pension funds, because we now have trustees with powers they did not have 30 years ago?”

But Labour peer Baroness Sherlock countered: “The Climate Change Committee has just reported that the Government are missing climate targets on nearly every front, which makes it all the more disappointing that they opposed a recent Labour amendment to the Financial Services and Markets Bill that would have required the Treasury carefully to review the case for pension funds investing in green infrastructure while maintaining the soundness of funds.”